Have 72 ships, 52.000 scouting ships per year, have 611 pilot & crews.

Have 11 operation area in Indonesia :

1. Teluk Bayur port, West Sumatera

2. Pulau Baai, Bengkulu

3. Jambi port, Jambi

4. Palembang port, South Sumatera

5. Pangkal Balam port, Bangka Belitung

6. Panjang port, Lampung

7. Tanjung Pandan port, Bangka Belitung

8. Banten port, Banten

9. Tanjung Priok port, DKI Jakarta

10. Cirebon port, West Java

11. Pontianak port, West Kalimantan.

The other name of PT. Jasa Armada Indonesia Tbk. is IPC ( Indonesia Port Corporation) Marine, this is the subsidiary of PT. Pelabuhan Indonesia II (Persero) - 99,86 % and PT. Multi Terminal Indonesia - 0,14 %.

PT. Pelabuhan Indonesia II (Persero) or Pelindo II which owned by the Government - 100 %.

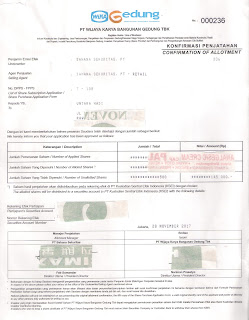

Underwriter : RHB Sekuritas Indonesia, period of public offering : 18 - 19 December 2017, List on IDX : 22 December 2017, Price : Rp. 380 / share.

Minimum buy : 1 Lot or 100 shares.

|

| At the stock offering booth in Bank Mandiri, Tanah Abang Timur. Jakarta. |

IPO = Initial Public Offering.